April 7, 2022

A harnessed approach to protection

Blog by Tanya Neethling, Key Account Manager, UnderwriteMe

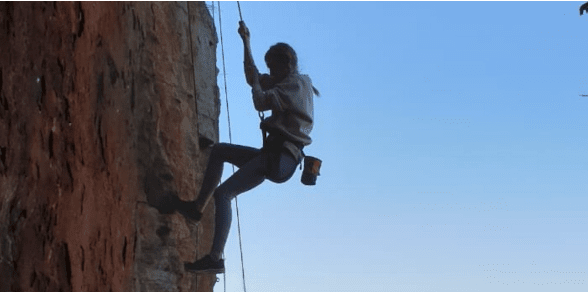

For too long applying for life insurance has felt like a free-style climb; uncertain, unsupported, and exhausting. Braving this uphill battle alone has meant one wrong step in the journey increases the chances to lose your grip, fall and ultimately have to start again from the bottom. In the world of insurance this means customers become frustrated and advisers’ become wary of the protection process which leaves client’s vulnerable whilst the sourcing carries on or never begins in the first place.

This traditional process of purchasing personal protection reminds me of my days of climbing solo and the dread and fear I felt climbing and sometimes not even starting the climb as I was so unsure.

In contrast, another way of climbing is by joining a group and climbing with a be-lay partner. Belaying is a variety of techniques climbers use to create friction within a climbing system, particularly on a climbing rope so that a falling partner is always secured to an anchor point and doesn’t fall far. My experiences were quite different when belaying and because of the additional support I received the initial dread and fear I had climbing ‘solo’ was never there.

There are two main aspects that you need to feel comfortable with to ensure your climb is safe for both yourself and your partner:

Support

Trusting your belay partner is very important in this process as they are essentially holding your weight while you climb, making it a safer journey for you and allowing you to take needed breaks along the way without having to restart the climb. The be-lay rope is designed to guide you along the way and provide a safety net in the event of uncertainty.

Tools

Your climbing equipment/tools always needs to be reviewed and updated to ensure the gear you are using is suitable for the climb and in the acceptable condition. If a climber does not check the equipment, uses a harness that does not fit, has a rope that’s been worn or shoes that have no grip, the climbers safety is in jeopardy and the needed safety-net is gone.

There are similarities with solo/belay climbing and applying for Life Insurance. The traditional process mentioned earlier can feel more like a solo climb, giving the feeling of dread, uncertainty and ultimately not wanting to start the climb due to the lack of support. However, this shouldn’t be the case anymore and with the enhancement technology can provide there is now a better way that like a belay climb gives you more support, trust and a safety net in case there’s a risk of falling throughout the journey.

The Protection Platform from UnderwriteMe is one system where you complete one application to access live underwiriting decisions from multiple insurers that ultimately allows you to submit business without the need to go into the insurers online journey. Because of this the Protection Platform offers you this belay approach when it comes to applying for protection, modernising the traditional journey and allowing advisers and clients access to a more streamlined and supported protection process.

What the Protection Platform can offer you is:

Speed,

by using our fast and reliable technology you have access to 9 provider decisions in one place. Allowing advisers to prepare quotations, underwrite cases and complete the submission in one platform. With the unnecessary running around and duplication cut out of the process, advisers can have more protection conversations and ultimately protect more lives.

Accuracy,

with live underwriting available at a click of a button the Protection Platform offers the ability for advisers to have informed conversations with their clients, putting the control back in the advisers and clients’ hands. Fully integrated with Defaqto, the Protection Platform also offers the chance to compare features and benefits instantly all on one user-friendly dashboard. Building trust by providing your client with clear outcomes from multiple insurers, giving you confidence that you’ve made the right recommendations.

Safety net,

because live decisions come back instantly from insurers on the Protection Platform even if a client discloses an unexpected medical condition halfway through the application you’re still in a better position than if you were just on one insurers online application. You’ve got the piece of mind in the knowledge that the Protection Platform will display decisions from all the insurers, not just one, putting you in complete control of managing client expectations.

Support,

as a fintech business, UnderwriteMe continues to lead technological advances in the protection and life insurance market. We have a dedicated team which is at the cutting edge of technology, and we also benefit from the backing of our parent company Pacific Life Re. A reinsuranceinnovator, Pacific Life Re provides a wide and detailed view of the market and share our desire to positively transform protection.

Let’s work together and conquer new heights in Protection. Sign up to use the Protection Platform today and see how the modernised approach can enhance your protection journey.