November 7, 2023

Breaking down gender disparities in purchasing and underwriting trends in protection

Blog by Steve Baldry, Director, Underwriting, UnderwriteMe

Looking at understanding consumer buying behaviour, and the influences sex has on underwriting can be insightful, and help to drive more effective and efficient underwriting, product, and sales development.

With this in mind, we looked at Protection Platform data to explore buying and underwriting trends between sexes over the past 5 years.

We found that differences in underwriting do exist. For example, our data tells us that men are more likely to disclose cardiovascular conditions such as blood pressure or cholesterol. The data also tells us that they are about 1% more likely to be rated due to it. We found that 6% more males than females are rated for diabetes, both stats correlating with population trends. In contrast, about 6% more women receive rated premiums for arthritis, also supporting the fact that women suffer from arthritis about twice as much as men. We know that women are more likely to outlive their male equivalents by around 4 years. Clearly, then, biology still plays an important role in underwriting outcomes and premiums.

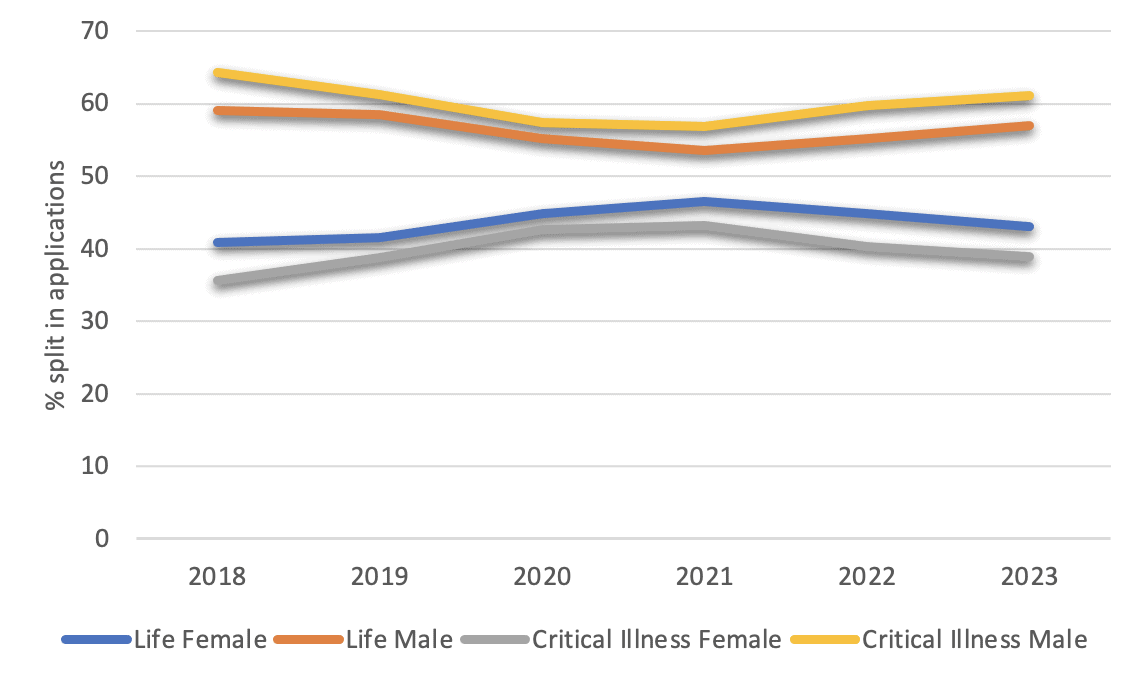

Outside of underwriting, we looked at trends in buying behaviour. Life cover sales on the Protection Platform are currently split 57/43 between men and women respectively, whilst sales of Critical illness are split 61/39. There are gaps in purchasing decisions, but we found that between 2018 and 2021 those gaps were slowly closing. In 2021, Women made up 46% of the Platform’s Life insurance market, and 43% of the Critical Illness market, a clear 3 or 4% more than there are now.

However, since 2021, that gap has grown again back to current levels. So, what’s happened? The drop in sales since 2021 corresponds with COVID-19, but shouldn’t COVID have emphasised the need for insurance, regardless of sex? Insurance policies are there to replace lost income or repay large liabilities whether you are in the workplace or shouldering other responsibilities like taking care of family members and managing a household – or a combination of both. Historically, social structures meant that often only the primary provider would own insurance or have cover through their employer, leaving an imbalance in the insurance ownership across a household. Perhaps we put too much emphasis on insurance that covers tangible liabilities such as a mortgage or loss of income when we should put equal weight on replacing social, maternal, and paternal responsibilities, or shorter working hours.

So, the links between insurers underwriting different risks and buying behaviour that reflects choice and need, is clearly a complex one. But, whatever the reason, there are real opportunities for insurers to understand their data, their experiences, and to build products and services that connect better to potentially underserved markets. There should also be the need for sales to target those large swathes of people without insurance. The percentage of males and females in employment after all, is not that dissimilar.

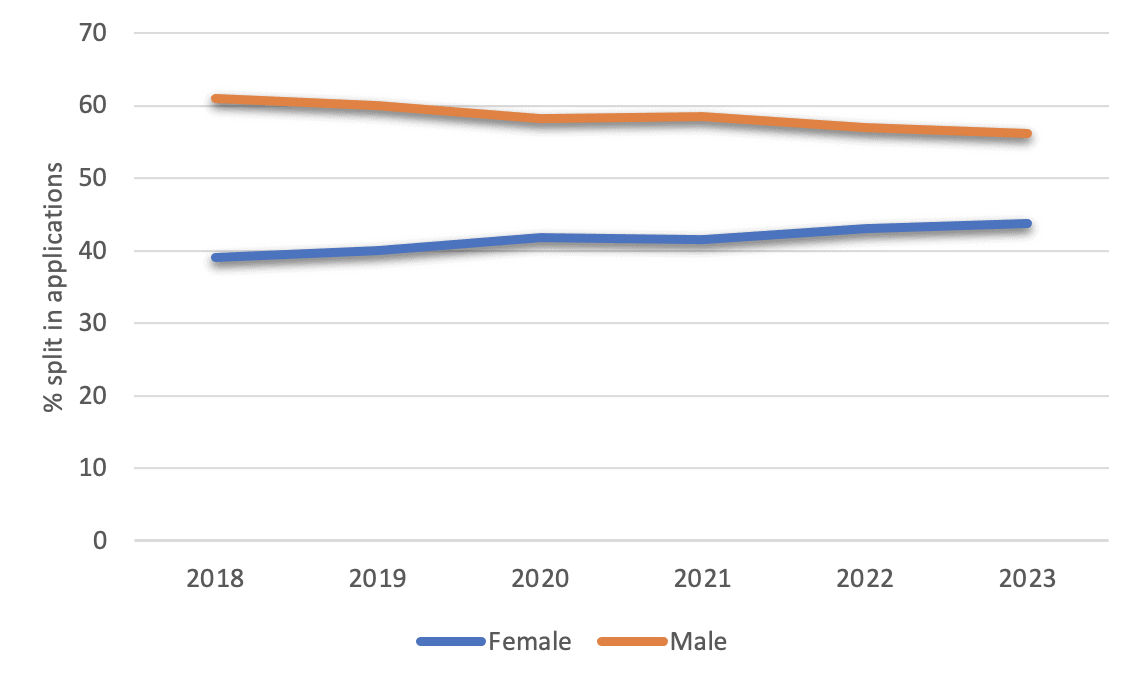

But there is good news. Income Protection appears to be bucking the trend. Since 2018, we have seen a slow and continuous trend in a bigger percentage of females buying the product. Something like 5% more in 2023 than there were in 2018.

We asked Jo Miller, Co-Chair, Income Protection Task Force (IPTF) and Director of Operations for Protection Review for her thoughts on our findings around gender disparities in purchasing and underwriting trends in protection:

“The fall in sales of life insurance to women is concerning albeit that it reflects trends that we are seeing in the wider market and might not necessarily be related to gender in the context of other societal trends such as high volumes of people renting and starting families later. What’s interesting is that more women are buying IP than five years ago. An increased awareness of our reliance on income following the pandemic means that perhaps income protection is seen as meeting more of an immediate, tangible need, particularly for a generation of women striving to be financially independent and starting families later. At the very least, it proves that protection products are appealing to women. Whatever the reasons for the sales trends we are seeing, I think we still have much to do as a market to communicate the value of protection for all types of customers, including highlighting the value that those who contribute to the running of households in ways other than bringing in income make.”

Kathryn Knowles, Protection Advisor, Cura, commented on the above chart:

“It’s such a shame to see that critical illness take up by women is dropping, but brilliant to see income protection going up. These statistics are a commentary of market trends, but it’s hard to know if this is a consumer trend or an adviser trend. I think it’s a mix. It’s important that advisers make sure that they do their best to show every client their critical illness and income protection options, so that the client can make an informed decision on their insurances.”

Visit our website here to learn more about UnderwriteMe or email us hello@underwriteme.co.uk.