October 18, 2019

FWD Takaful goes live with UnderwriteMe’s technology

FWD Takaful Berhad (formerly known as HSBC Amanah Takaful (Malaysia) Berhad) (“FWD Takaful”) has recently launched a new and revolutionary digital platform that provides customers with immediate Takaful protection and coverage online.

This represents the first phase of FWD Takaful’s customer-led digitalisation model and offers FWD Protect Direct, Malaysia’s first Takaful protection plan that can be participated online, covering up to four family members under one certificate with automated underwriting.

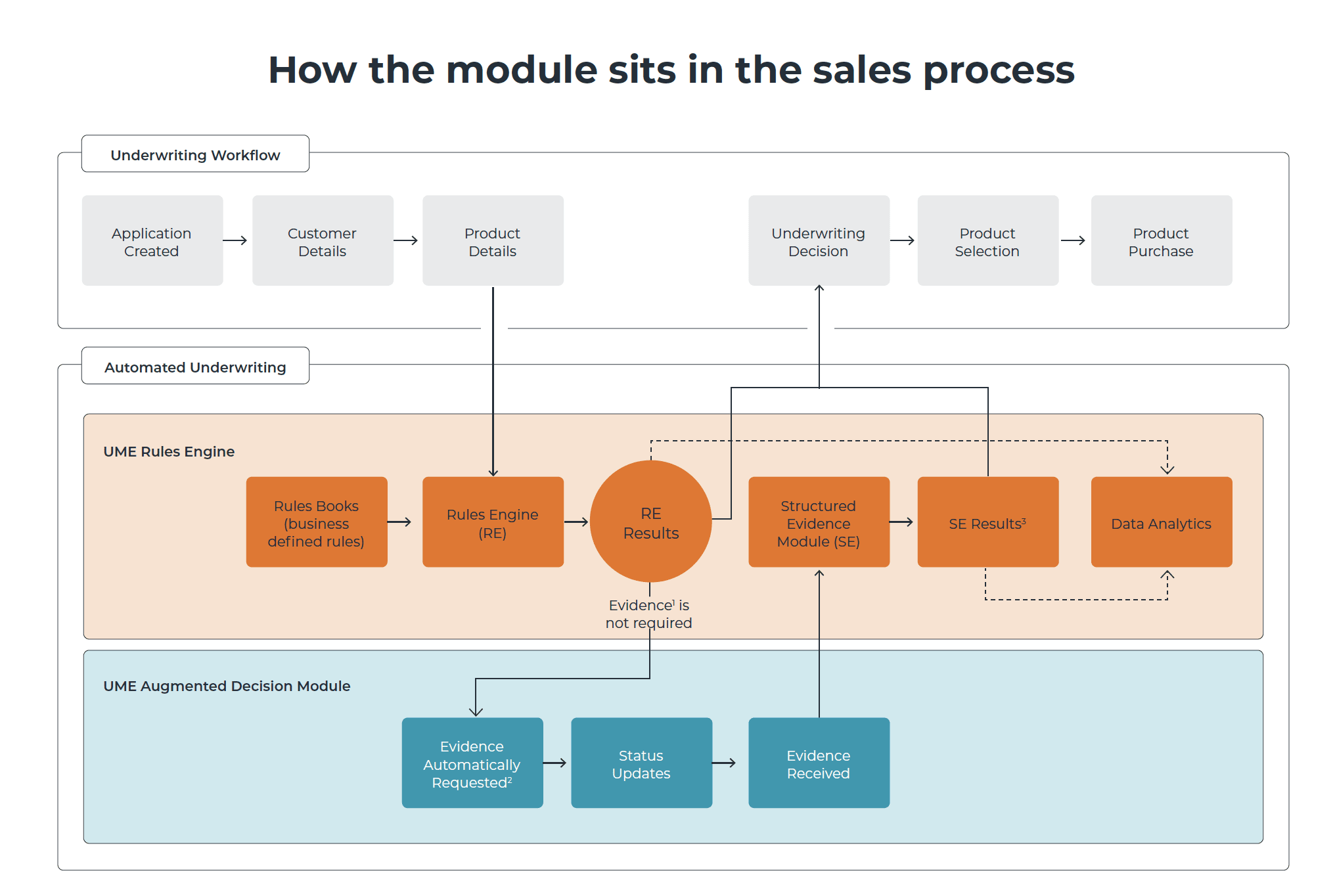

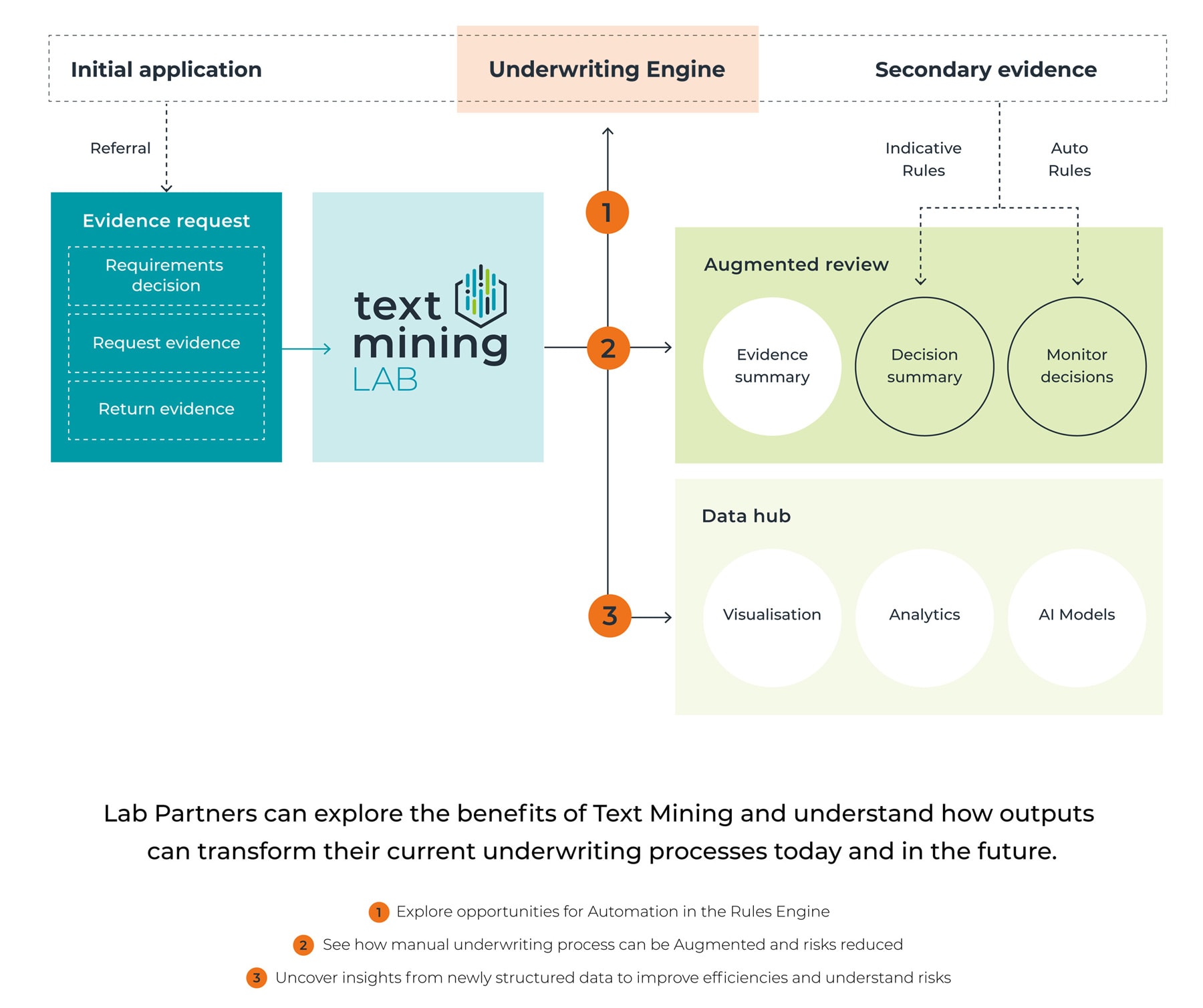

This online channel is built on the Underwriting Rules Engine (“URE”), which is powered by UnderwriteMe, Pacific Life Re’s wholly-owned subsidiary. It is the first URE solution to be hosted on the cloud in Malaysia. It is designed to deliver an exceptional customer journey with fewer application questions and providing instant prices, making it easier for customers to participate online without filling in long and cumbersome forms in traditional industry practice.

This new platform brings FWD Takaful’s vision to life as it seeks to change the way people feel about Takaful and also aligns with Malaysia’s wider efforts to promote greater accessibility and a wider range of life insurance and family Takaful products.

Rakesh Kaul, Director of Business Development for UnderwriteMe, commented, “As the first Takaful operator to use the UnderwriteMe solution in Malaysia, FWD Takaful has set a benchmark in terms of technological leadership. Completion of medical underwriting online, faster processing of applications and a much better journey is what today’s consumer expects and we are pleased to deliver a solution that will allow FWD Takaful to grow in years to come.”

Acknowledging UnderwriteMe’s role in its online channel, Salim Majid Zain, Chief Executive Officer, FWD Takaful said, “The fully automated system is truly a market differentiator. The intuitive user interface is based on responsive design supported by help texts, offering our customers both ease and convenience. This dynamic system complements FWD Takaful’s customer-led approach, which is simple, reliable and direct.”

Vasan Errakiah, Head of SEA Marketing, Product Development & Alternative Distribution, Pacific Life Re, concluded, “FWD Group (“FWD”) has always been ahead of the curve for its cutting- edge strategies and we are thrilled to be partnering with them in transforming and digitalising the local life insurance and family Takaful industry. Aside from the digital solution being a game changer, the adoption of UnderwriteMe’s technology will provide our partners with a competitive advantage and supports our commitment and vision to encourage sustainable growth for our partners in Malaysia.”

This follows closely behind the recent successful implementation by UnderwriteMe for FWD Singapore. Plans to implement this solution for FWD in additional markets across Asia are underway.