November 2, 2018

New products are no good without new business

Protection has really started to change over the last few years. While the upper echelons of most major insurers remains largely pale and male, we’re seeing the tangible effects of industry efforts to redress the gender and ethnicity imbalance, with senior female executives gaining prominence and a more interesting array of faces populating panels and podiums at conferences and events.

New entrants to the sector have also altered the dynamic, with the bearded, tattooed cool kids who spearheaded the general insurance digital revolution setting down their mochaccinos to focus on the life market.

However, much of this fresh impetus has been aimed at what I think is the wrong end of the problem. In particular, new brands entering the fray have almost all focussed on creating neat, customer-centric products alongside slick underwriting and application processes; borrowing from the digital improvements in the GI world.

That’s fantastic but I’m yet to see how most are going to attract new business. Those, like Guardian, who tested and learned in the intermediary market and see advisers as the best route to clients I can understand. Similarly, established players such as AIG who recognise the opportunity of partnering with large third parties to leverage an existing customer base seem destined for success.

But there appear to be some shiny new propositions which have everything nailed except for the volume of traffic needed at the widest end of the funnel.

In working with some of the UK’s largest sellers of Protection, both direct to consumers and via advised and non-advised intermediaries, we know that the real key to market growth lies in improving the conversion from enquiry to purchase.

For price comparison websites (PCWs) this metric is the ultimate measure of whether their latest animated animal, 80s cartoon reboot, or operatic jingle campaign was a success or a flop and for each of their product lines, determines how much of that precious marketing budget is deployed in its name next time around.

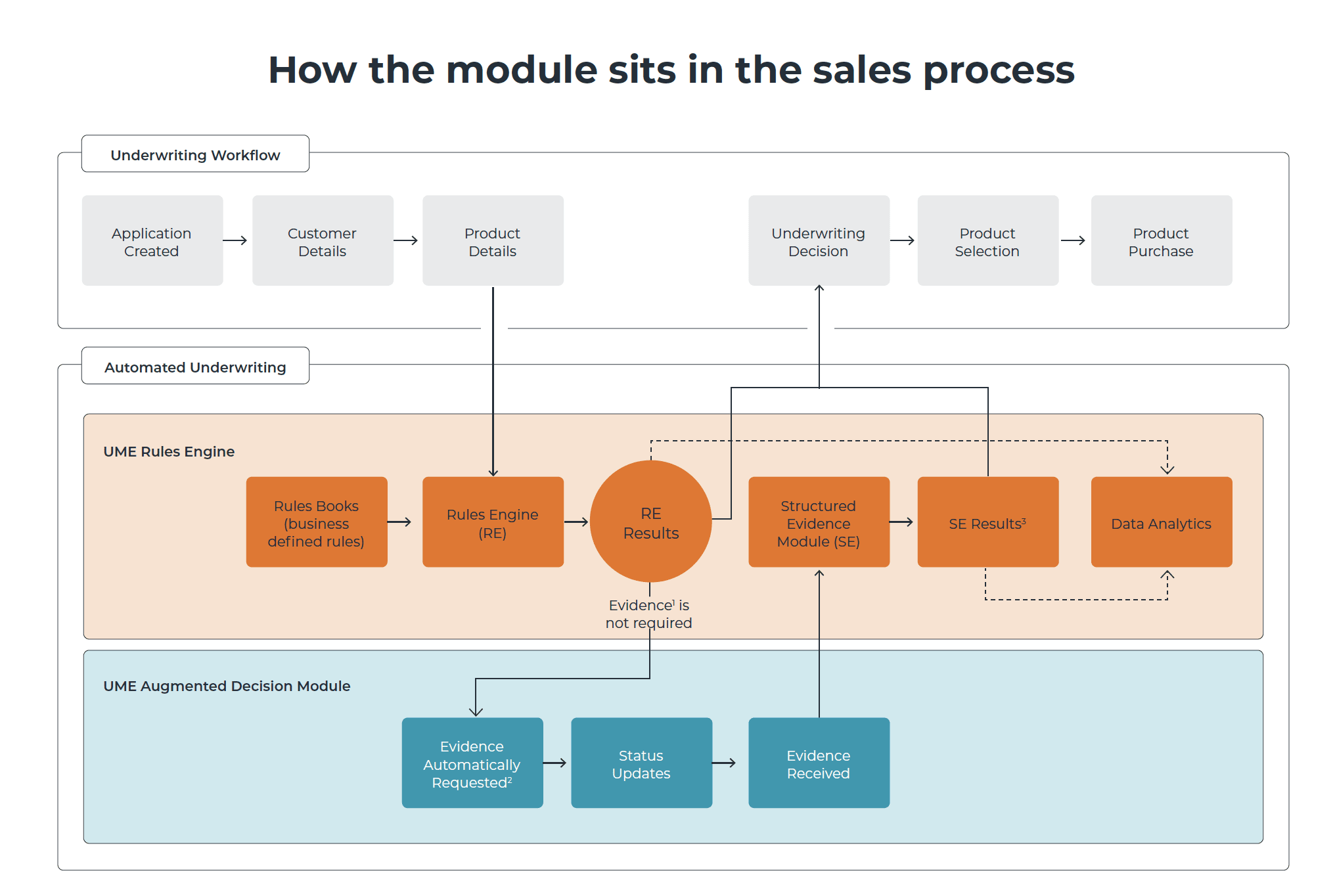

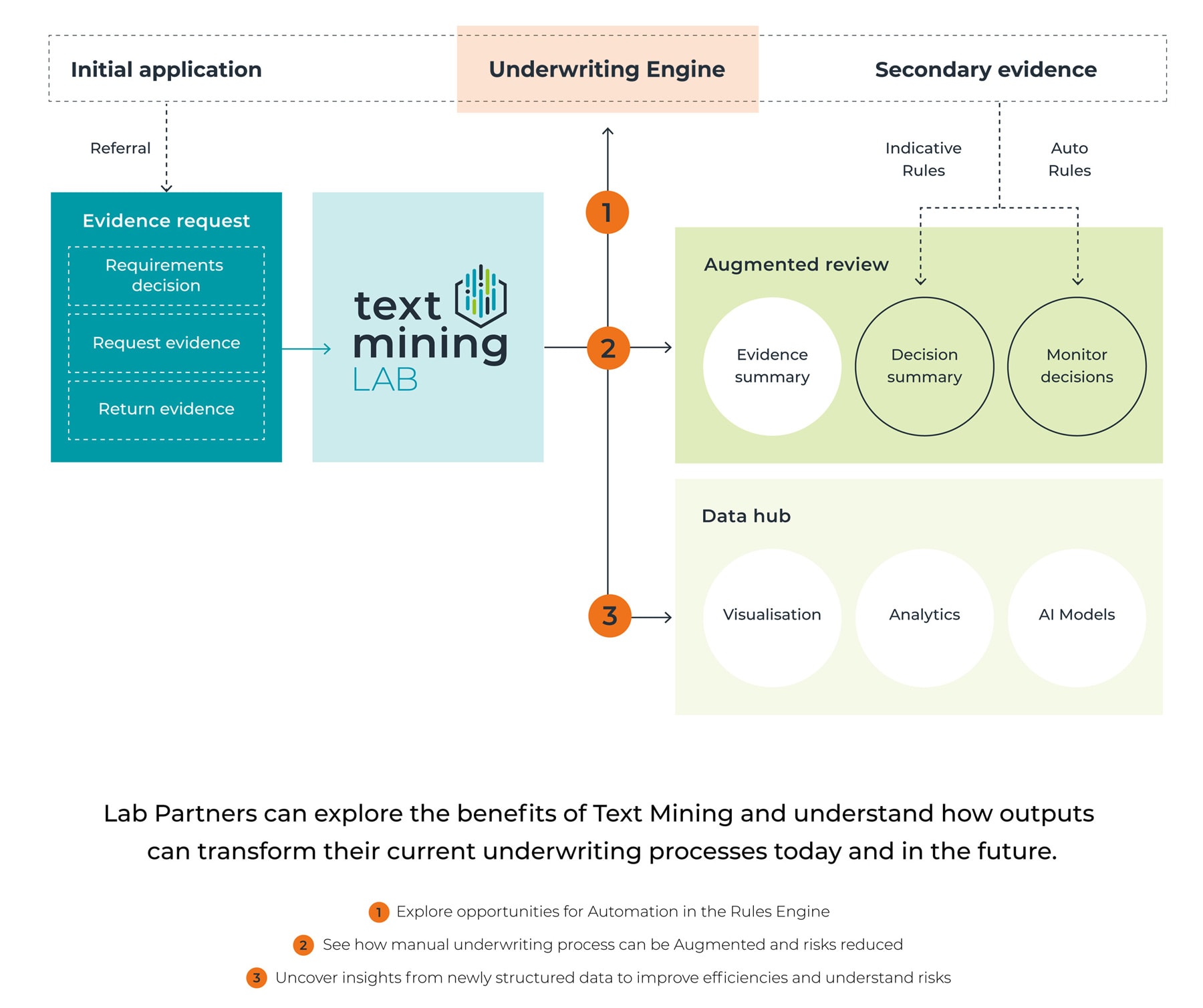

To date, intermediaries including PCWs have had little or no control over the meatiest part of the sales process – underwriting – but technology like ours means that the balance has shifted somewhat and at last the sellers, the real experts in customer behaviour, own the journey in partnership with forward-thinking insurers who recognise that, to use retail as an analogy, it’s the shopkeeper who knows best how to work the till.

Clearly, we need new entrants and new routes to customers if we are to see material growth in the sale of Protection, but we should not overlook the sizeable opportunities which sit under our noses. Intermediaries, be they networks of smaller firms, large specialist outfits, mortgage brokers, banks or online aggregators all tell us the same thing and have done for decades: if you make it easier for us to sell it, more customers will buy it.

Thankfully, it appears that message has been heard and we are now empowering those best placed to mould the future.