April 29, 2021

Text mining: The next frontier of underwriting technology

2020 was a year of learning for all of us. COVID-19, Furlough, banana bread and how to wear face masks all adding to the “things that I learned from 2020” list. Beyond that, many people used the time back from the commute to re-engage with a fitness regime or tried to pick up a language, Duolingo is still sending me daily reminders to practise my Portuguese.

But when I heard about Text Mining I said, “Ooooh that sounds clever.” My late dad gave me the same response when I first described email to him. I was a bit embarrassed. The trouble is Financial Services is an industry where we both; like using big incomprehensible words to describe ourselves, and at the same time don’t always use technology as well as we could do. So, I was determined to listen and soak up the content from the new team and it led me down an interesting (well interesting for Financial Services) path.

What is text mining?

Well, first up there are a number of different building blocks we need to cover before we get to it and they are Artificial Intelligence and Natural Language Processing. What do we actually mean by these?

Trying to simplify these concepts isn’t always easy, but as a simple person – here’s my attempt:

When I googled “what is Artificial Intelligence?” it produced over 738 million results, but the short version is that Artificial Intelligence (or AI as it’s more commonly known) is described as “The capability of a machine to imitate the intelligent human behaviour.” Leaving aside the fact that “intelligent human behaviour” includes me walking into glass patio doors on a regular basis, AI is a very wide catch-all phrase and more research was required.

I realised there was a great example of AI literally on my doorstep. The Delivery robots in Milton Keynes first appeared for testing in 2018. They are small little mini cars that navigate the roadways and pavements of Milton Keynes to deliver groceries. They machine learn all the routes around their area and “interact” with the environment around them (cars, pedestrians, cyclists and curious pets). Like all technology starts, they have had to adapt but COVID put these machines at the very front of customer service, and they continue to rise in popularity.

Next is Natural Language Processing (NLP). NLP is the relationship between computers and human language. But what does that mean? Put simply it allows computers to read text, hear speech, interpret it, measure sentiment and figure out which parts are important. The U.S InsurTech Lemonade uses NLP in its customer service chatbots. It makes it possible for Lemonade to answer its customers’ questions and also carry out a number of basic Insurance customer service tasks such as sending a new policy to a new address when a customer moves or cancelling a policy. Moreover, they can also instantly review or pay a claim. A real change to customer experience for Insurance.

The definition of Text Mining is clustering or categorising groups of text using automatic processes, i.e., using AI and NLP specifically to focus on text. An example of this is some work Amazon completed on what drove customers to rate headphones highly. They collected the product rating data and then “mined” the text describing the product (words like portable, chargeable, sound quality, battery life were amongst the main features). This automated assessment concluded that sound quality was the key driver for a high rating, something I’ve learned the hard way from a speaker purchase from the middle aisle of a discount supermarket.

After understanding the basics, the natural question is how these tools will be used in Financial Services and are we making progress in these areas (some of which seem to have been around for years).

Adoption

In a report published by Statista, the US banking industry has widely adopted these techniques and business derived from AI is expected to hit $301BN by 2030, with significant growth in the next two years. The deployments in US banking include using AI predictive analytics tools to offer real-time financial advice. These combine chatbot messaging, analytics and purchase tracking to offer real-time advice on spending and saving habits. Pefin, Cleo and Wallet.AI are all examples of the banking sector using AI in a really clear and beneficial way. These tools have been especially applicable to millennials, who may have had low trust in banks and have a strong mobile-first approach to products and services.

Closer to home Lloyds Banking Group partnered with Pindrop to help combat fraud. Pindrop’s software uses natural language processing to create an “audio” profile of the customer, identifying 147 different features of a human voice from a single call. They use this to detect any unusual activity.

At UnderwriteMe, we’ve endeavoured to transform the life insurance market across the globe. Whether it’s the Protection Platform in the UK or our Underwriting Rules Engines across Europe, Asia and soon the US; we’ve tried to stay on the front foot in using technology to improve the customer journey.

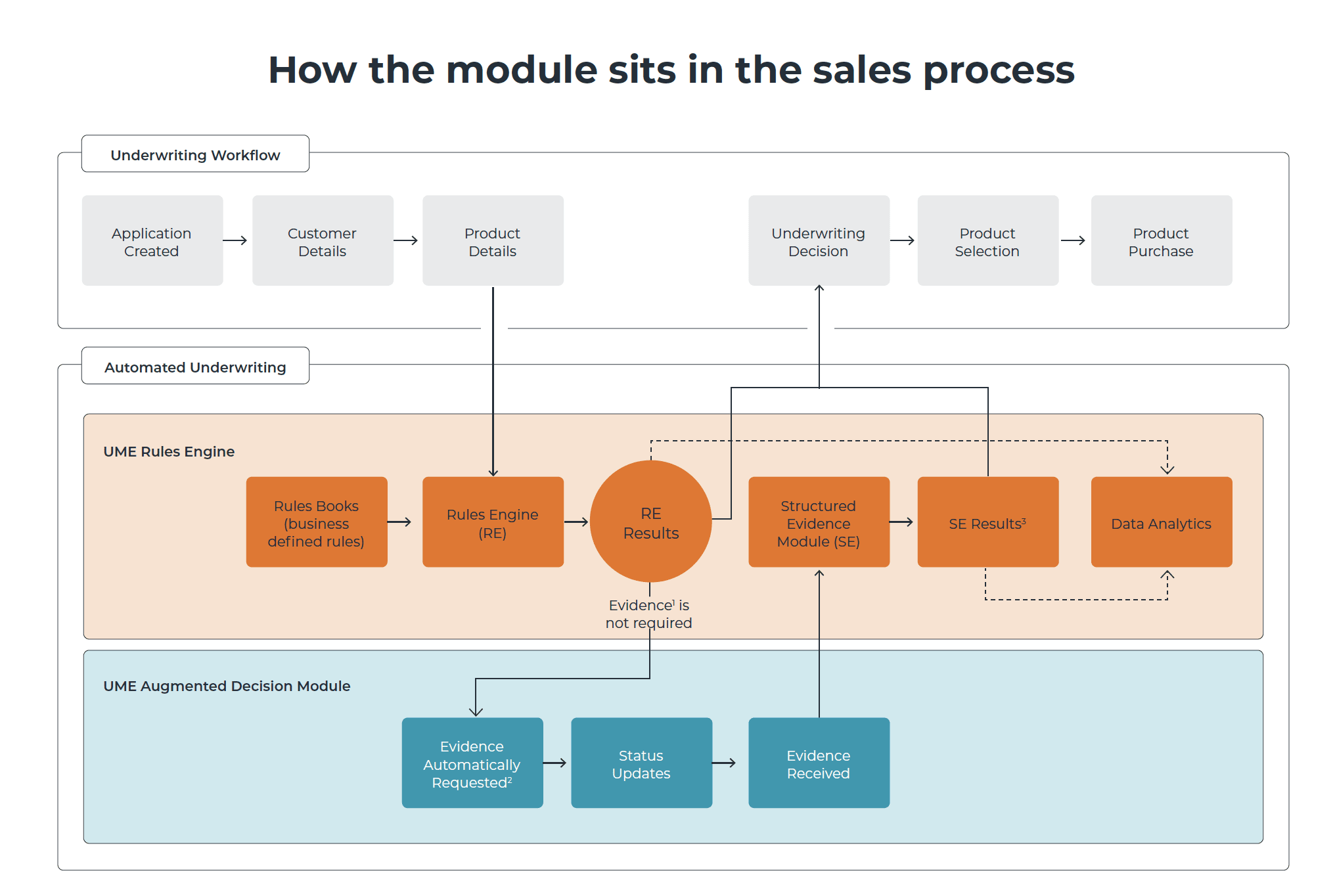

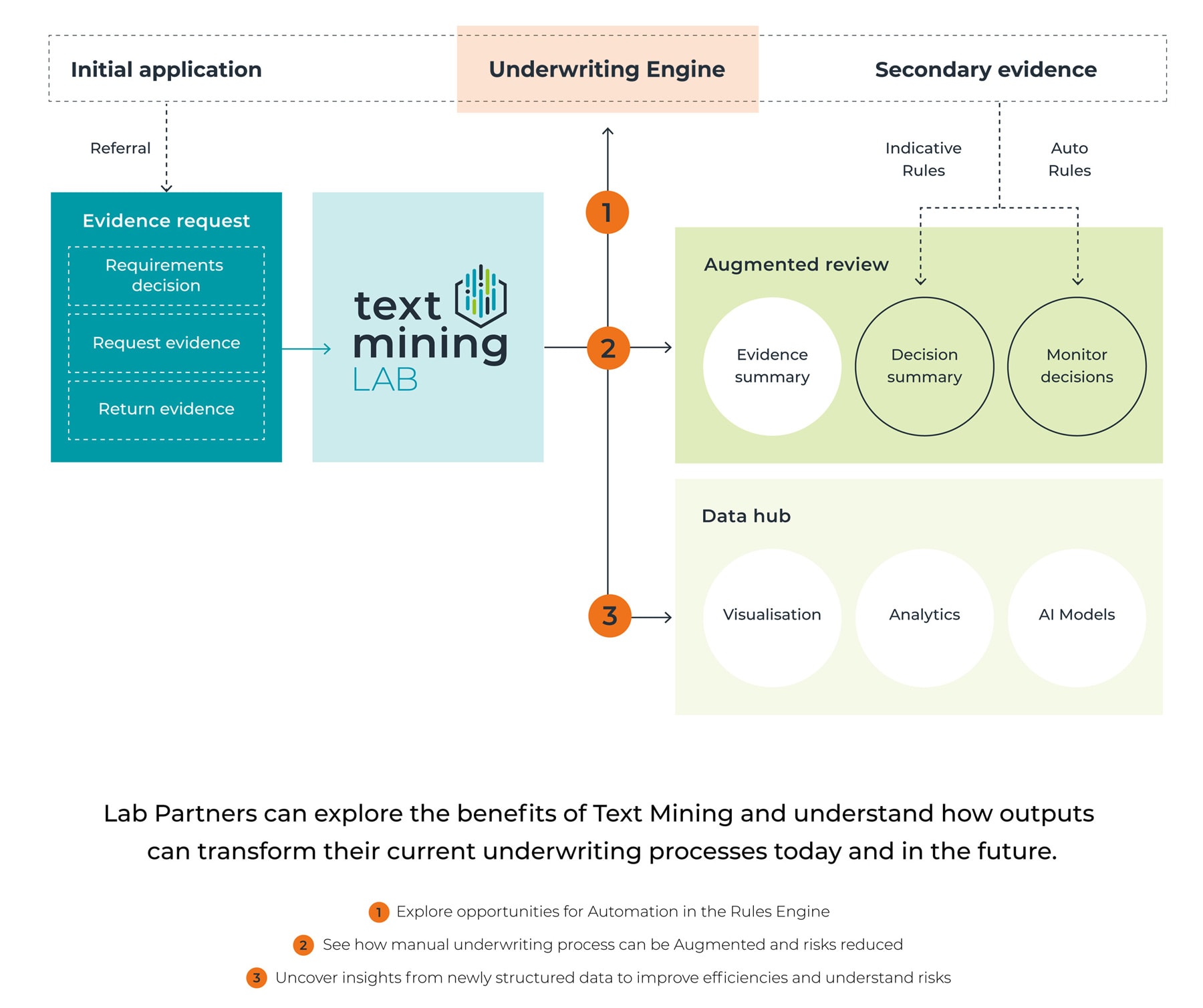

Our first focus for using these techniques is (unsurprisingly) on the underwriting process. Whilst our work up until now has been to improve straight-through processing for advisers and insurers alike, there is still a large percentage of customers who need to provide further medical evidence to support their applications.

This evidence is broadly split into two types – structured and unstructured. An example of structured evidence would be a blood test. The results of the test might be a simple yes or no to a condition the underwriter is interested in. Our structured evidence assessment tool allows an automated flow of that data back into the underwriting system and process of the insurer. This use of text mining further streamlines processes and allows underwriters to focus on more complex cases. But there are further benefits, text mining also provides access to a new source of data for analytics. This will allow underwriting teams to advance pricing strategies, assess portfolio risks and identify emerging risks. In that respect, the recent health crisis has put even more emphasis on embracing this technology.

New ground

The new ground UnderwriteMe is covering is around unstructured data. Kristina Bordas, Product Owner for UnderwriteMe, explains the challenge,

“Quite often the underwriter is reviewing a medical condition which may have a raft of notes associated with it gathered over a significant period. These notes may be provided to insurers to help further assess the risk of insuring the customer. Potentially, the underwriter might need hours to trawl through the notes looking for certain conditions, descriptions of severity and results of related tests and investigations. Our team has started creating automated tools to assess these reports, understanding the context of relevant medical conditions to effectively summarise them.”

The impact of this work shouldn’t be understated. Our research suggests that there is a significant drop in the conversion rate of “referred” cases to on-risk policies when the delay in resolving these cases goes above 28 days. As an industry we often talk about accessibility to insurance, we genuinely hope that our work in this area will allow the customers most in need of cover the ability to get it.

Our new team has some interesting backgrounds. Kristina was the lead data scientist at Lloyds Banking Group, where she worked on the first machine learning projects for the bank. She’s an award-winning innovator and features on the Women in Fintech Powerlist. Working with Kristina is Paul Harrington, a vastly experienced technical lead who has been in the UnderwriteMe team for four years. They are both joined by underwriting expert Dave Russell. Dave has 15 years of experience in the UK Protection market and worked closely with the University of Manchester (Nactem) to develop the proof-of-concept text mining model.

We’re excited that this work will not only bring significant benefits to Insurers but also provide a better, faster customer experience for those customers who need cover the most.

2021 looks like the year that text mining will make a big impact on the life insurance industry, we’re excited and delighted to be leading the way. Now back to learning Portuguese in time for the 2022 holiday…