July 18, 2017

Underwriting innovation across Ireland, Asia and Australia

Digital insurance specialists, UnderwriteMe, have seen their Underwriting Rules Engine chosen by insurers in two new territories, along with a second partnership in Ireland. The engine will be at the core of digital transformation for Dublin based Friends First, Singapore Life, a new entrant to the Asian market, and Australian insurer MLC Life Insurance.

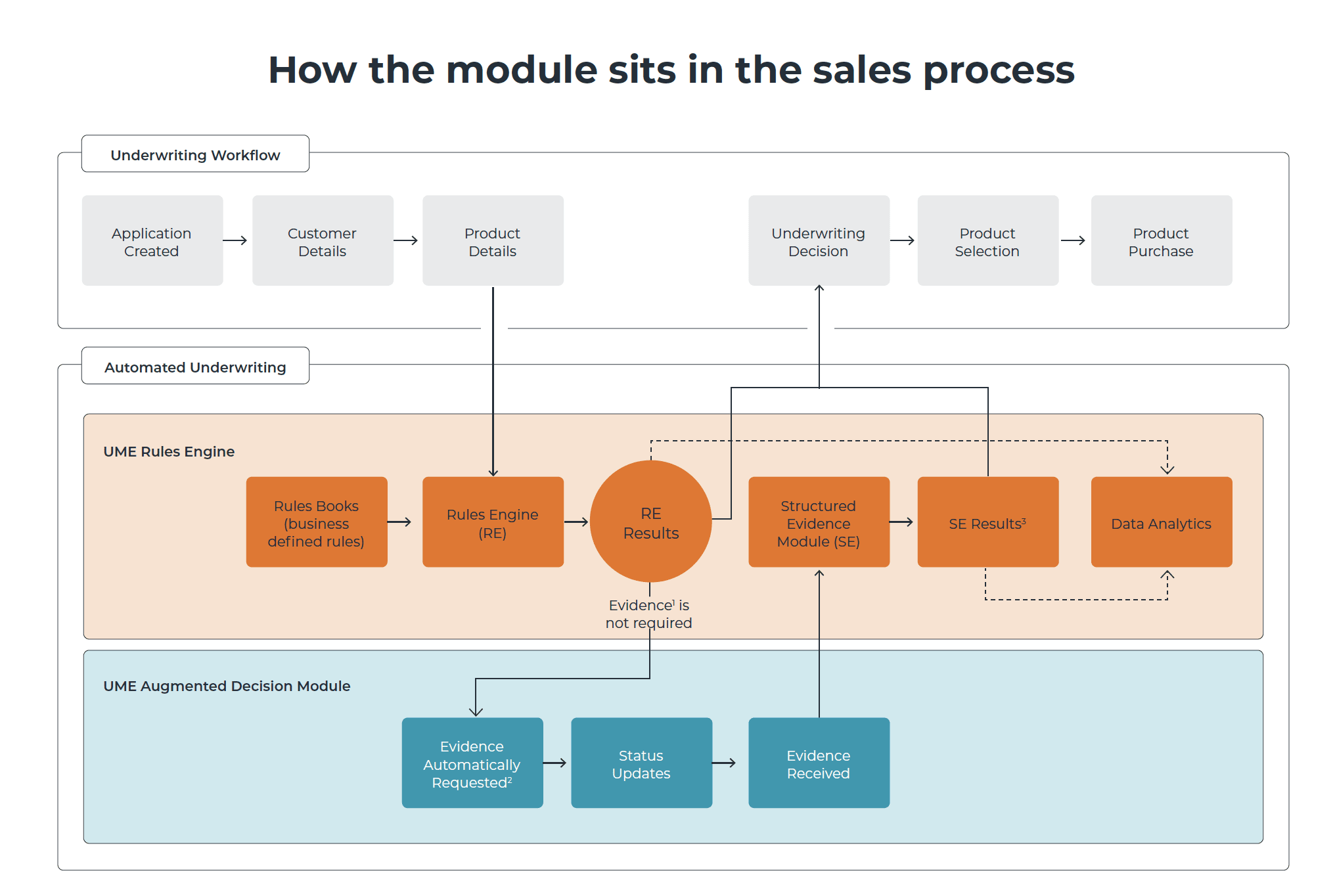

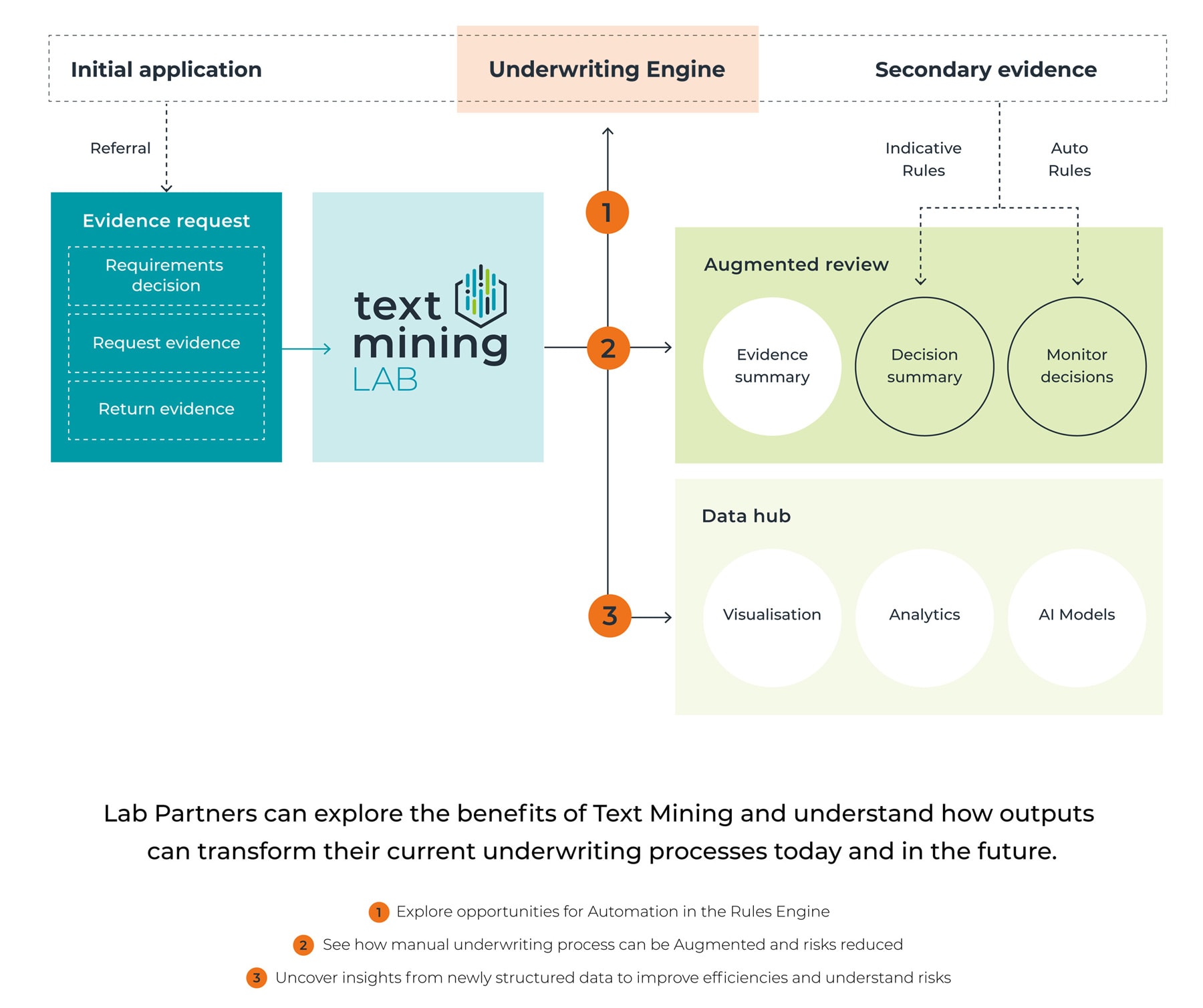

Developed by leading risk specialists, UnderwriteMe’s technology combines the latest digital innovations with automated underwriting solutions, with the aim of transforming the buying and selling process.

Singapore Life, MLC Life Insurance and Friends First believe the technology will modernise underwriting for their firms, by reducing complexities in the purchase journey and offering an efficient, transparent and flexible process.

For MLC Life Insurance, testing has indicated that UnderwriteMe will double straight-through acceptance rates, insuring customers without the need for onerous manual underwriting.

Melissa Heyhoe, Chief Customer Officer, Retail Advised Insurance, MLC Life Insurance, said:

“Underwriting has traditionally been a complex and time consuming process. People applying for life cover typically fill out lengthy questionnaires about their health history, some of which are not relevant to inform their overall risk to us as a life insurer. By automating the underwriting process with UnderwriteMe, we’ll be able to ask customers fewer and more relevant questions, and therefore get a more accurate assessment of their risk. We think it will be a game-changer for the industry.”

Niamh Mannion, Customer Service Manager with Friends First commented on the partnership:

“Friends First are very pleased to be engaging with UnderwriteMe to provide an innovative solution to streamlining our business processing. Providing this type of automated underwriting not only has benefits to our business but will also ensure an enhanced user experience for our customers.”

Phil Jeynes, Head of Sales & Marketing for UnderwriteMe commented:

“Having established ourselves as number one in the UK market*, it is exciting to see our rules engine adopted in other countries. These are the first of many new partnerships around the world, as we use the power of digital technology to revolutionise the way life insurance is underwritten, with a view to unlocking its huge sales potential.”

*NMG December 2016